Latest News

6 steps to create a mentally healthy and vibrant workplace

It’s estimated we spend a third of our life at work. It may even be more if you run your own small business. From working overtime during the week to catching up on paperwork on the weekend, having enough time to get everything done is a challenge for most small businesses.

.

So, it’s easy to understand why you might not feel like you have the time to think about your own wellbeing let alone the wellbeing of your employees or your co-workers. However, understanding how the people in your business are coping with both life and work pressures is just as important as paying your suppliers every week or doing a stocktake.

45% of Australians experience a mental health problem at least once in their lifetime.

In 2022, 52% of serious mental stress claims in Australia were because of work-related issues. These issues included harassment, bullying, work pressure and occupational violence.

Poor workplace wellbeing affects workers’ mental health and productivity, costing our economy up to $22.5 billion a year. Asking a colleague ‘R U OK?’ may begin a conversation that not only helps them but also helps build a healthy workplace.

This year, R U OK? Day is on Thursday 12 September 2024. The day serves as a reminder that asking, ‘are you ok’ any day of the year is important to the mental health and wellbeing of those around you.

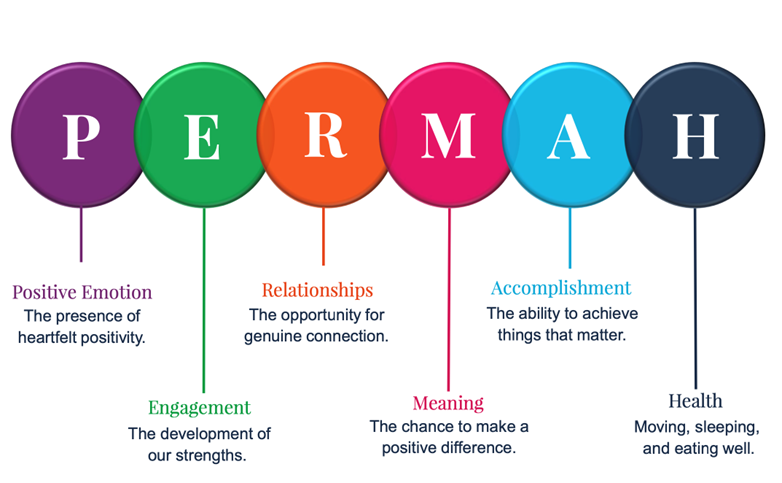

One way to improve workplace wellbeing, safety, and performance is to use Dr Martin Seligman’s (2012) PERMAH framework. This evidence-based model highlights 6 factors that help us feel good and perform well at work. Workplace culture can be improved by prioritising these 6 elements.

1. Positive emotions: ‘AMP’ up your understanding of stress

A healthy workplace is not absent of stress, but it is one where people know how to manage it. Stress is natural, especially if you run your own small business. Often, it’s our body’s way of trying to alert us that something we care about is at stake.

By noticing the signs of stress in yourself and your employees, Associate Professor of Psychology at Standford University Dr Alia Crum, found we can harness our body’s stress responses to help us meet life with the energy and courage we need to deal with whatever is at stake.

You can help your workplace ‘AMP’ up an understanding of stress by encouraging your people to:

Be Aware when they feel stressed, that their body is trying to get their attention by making them feel uncomfortable (sweaty hands, racing heart, tight jaw or hunched shoulders).

Find Meaning for these feelings by asking them what's happening that's important and may not be going the way they want.

Prioritise Conversations and/or actions that can positively impact the outcome of what's unfolding. Remember, tiny steps can have a mighty impact because they motivate people to move forward with confidence.

Whether you’re a sole trader or run a small team, understanding the signs of stress can help keep you and your employees in a positive frame of mind. Sometimes stress can’t be avoided, but we can manage how that stress affects us and do things to help reduce it.

2. Engagement: give strength-focused feedback

High-performing teams share nearly 6 times more positive feedback than average teams, while low-performing teams share nearly 2 times as much negative feedback as average teams. Make giving strength-focused feedback to your employees a priority, and easier and more effective by using the ‘THANK’ method:

Track: What is the positive impact you’ve seen this person’s work having recently on others? How specifically might they be making work or life easier or better?

Highlight: What can you see them learning, doing, and/or delivering that is making this positive difference that you value?

Appreciate: What strengths – the things they are good at and enjoy doing – can you see being used to make this effort and/or outcomes possible?

Nurture: How can these strengths be built on? How might they avoid overplaying or underplaying their strengths that could help improve their performance?

Kindle: What support might they need/want and what does this look like?

3. Relationships: build psychological safety

Vibrant workplaces welcome honesty, prioritise learning, encourage asking for help, and support taking risks together. Everyone struggles at work from time to time. Workplaces that normalise the feeling of struggling can promote healthy learning and growth.

Removing any barriers or embarrassment to having open conversations can help unlock the potential for people to become better at their jobs. Psychological safety can be built by using the following Safety Check Chat questions to check in with your team:

What’s working well?

Where are we struggling?

What are we learning?

What do we want to try next?

Four people in an office sitting at their desks, laughing on a coffee break.

4. Meaning: create a giving culture

We long to be more than the sum of the tasks we perform at work. The good news is researchers have found that meaning can be found in any job by helping people identify the difference their work makes to others. Encourage a healthy workplace by getting people to invest in 5-minute favours that make a positive difference in someone else’s life by:

offering to help with a hands-on task

sharing their expertise (i.e. offering their skills)

coaching or mentoring others (i.e. teaching someone how)

passing on favourite resources (i.e. books, podcasts, articles, recommendations)

supporting a colleague by listening to their struggles and/or successes.

5. Accomplishment: setting and celebrating learning goals

A vibrant workplace is one that learns and understands failure and mistakes are part of how things are accomplished. They do this by embracing a ‘growth mindset’ that recognises that while we all bring to the workplace certain talents, abilities, and intelligence we can improve upon these with learning, practice, and support. To help your team develop their growth mindsets you can ‘SET’ learning goals:

Spark your curiosity: Challenge your mind by picking a small learning goal that can make a big difference.

Experiment: Act on your learning goal within the next 24–48 hours. Remember as long as you show up, give your goal your best shot, and stay curious about the results, you can’t fail.

Tune into feedback: Measure your progress, seek feedback, and reflect on what you’re learning to move closer to your goals.

6. Physical health: the need for rest and recovery

Vibrant workplaces recognise we are built to swing between periods of activity and recovery. They understand the power of short breaks throughout the day. In turn, this helps people stay energised, healthy and more productive.

Recovery doesn’t mean you need to take a nap in the backroom or under your desk. Researchers have found that short breaks allow the thinking parts of our brains to rest. This can be just as effective as naps. Here are some easy ways to add these to your workplace:

Encourage ‘walk and talk’ meetings/discussions where possible.

Encourage shared lunch breaks, eating together away from desks or finding an external lunch location.

Provide exercise cards/posters for quick stretches between tasks.

Organise fun workplace challenges that encourage activity and involvement, e.g. a sit-stand challenge to see who can hold the position the longest.

Allow short social breaks like tea/coffee conversations, which help rest the brain and build connections between employees.

How to create change in the workplace

Business owners and leaders may face challenges when trying to bring about behaviour changes. Professor James Prochaska, (a leading researcher in behaviour change), highlights that there are 3 common derailers when it comes to caring for our wellbeing. These include:

‘I don’t want to’

‘I don’t know how to’

‘I don’t think I can’.

Creating safe places for people to learn and grow can be a strategic way to help overcome these barriers. Business owners can do this by tapping into curiosity rather than judgment, as well as encouraging their employees to switch their mindset about how to deal with people:

Instead of making assumptions, slow down and ask questions to understand.

Rather than being embarrassed to ask questions, assume learning is helpful and seek/offer support.

Instead of complaining about someone’s performance, assume everyone is capable and spark kind conversations to enable growth.

Rather than pointing the finger and blaming others, encourage shared responsibility and create transparent and safe spaces for accountability.

Building a vibrant workplace culture is an ongoing process requiring long-term strategies. A learning loop can be helpful to enable continuous improvement:

Act: What have you tried? Why did it matter to you?

Assess: What went well? where did you struggle? What did you learn?

Adjust: What will you try next? Do you need support?

Building a healthy and vibrant workplace isn’t something that can be done overnight or something that you must do by yourself. It’s done by encouraging a workplace culture of positive behaviours every day. It’s the small things that count in the end. Researchers suggest that small and consistent ‘wellbeing wins’ amplify our confidence and motivation so we can scale up our efforts over time.

Small changes can have big results

In a vibrant workplace, people feel safe, energised, and ready to collaborate. They’re resilient and productive, navigating both highs and lows as part of learning and growing together. Ask yourself, are you creating and leading a vibrant workplace culture?

Start implementing the frameworks and wellbeing strategies above. Your proactive commitment to making even one small change today can make a meaningful difference both now and in the future.

Let’s make R U OK? Day the opportunity to not just ask this vital question, but to create sustainable and vibrant work environments where wellbeing is prioritised and businesses perform at their best. For more information on R U OK? Day, visit the R U OK website.

For more information on building resilient people, healthy relationships and vibrant workplaces, visit the Wellbeing Lab website.

Tools to improve your workplace’s mental health

Work Safe Victoria’s mental health: safety basics

The Victorian Mentally Healthy Workplaces Framework | vic.gov.au (www.vic.gov.au)

Mental health support services

Mental health support and assistance services

Free support and advice with Partners in Wellbeing

THE WELLBEING LAB

12 SEP 2024

business.vic.gov.au