Team

working

towards a common goalAbout

Professional

services for business and individuals

Wybenga & Partners Pty Limited is a small/medium firm of Chartered Accountants established in 1994, specialising in taxation, superannuation, and small business advisory services. July 2016 was a significant milestone in the history of the Firm, which saw us expand our skills into financial services allowing us to be a more full-service operation. The Firm currently consists of 5 directors and 15 employees.

The Firm was originally established to provide taxation, accounting, and compliance services to a financial planning organisation and their clients. As well as maintaining many of these relationships, we are now offering these financial services in house, allowing efficient flow of information across our two business modules.

We have significant experience and insight into the operation of various investment vehicles including Companies, Trusts, and Self-Managed Superannuation Funds. Besides attending to our client’s compliance obligations, we pride ourselves on matching our clients with the most effective business and investments structures for their needs.

The growth of the Firm since its establishment has seen the expansion of our client base to include a large number of small and mediums sized business clients who operate in a diverse range of industries. As a result, advice and assistance to small/medium businesses has also grown to be a core part of our expertise. Our philosophy is to demonstrate ethics and integrity in everything we do. Our client relationships are the foundation of our business and it is our mission to foster and grow those relationships over the long-term.

Our Services

diverse

range of expertiseLatest News

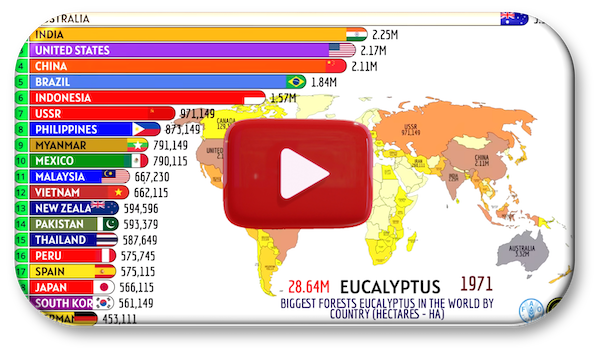

Countries with the largest collection or eucalyptus trees

Check out the countries that have started to grow their eucalyptus tree...

Super gender gap slowly narrows

The latest Financy Women’s Index (FWX) for the September quarter has shown the superannuation gender gap is...

Protecting yourself from misinformation

The Australian Taxation Office (ATO) has observed websites attempting to harvest personal information such as...

A refresher on Medicare levy and Medicare levy surcharge.

The Medicare levy’s a compulsory charge of 2% on taxable income, which helps fund Australia’s public...

Payday Super part 1: understanding the new law

Passage of the Payday Super reforms by parliament this week has cleared the way for employee superannuation to...

ATO’s holiday home owner tax changes spur taxpayers to be ‘wary and proactive’

Following on from the Tax Office’s move to refresh its approach to rental property tax deductions, tax...

Choose the right business structure step-by-step guide

Take out the guesswork out of choosing the right structure for your business . Sole trader? Company...

Restructuring Family Businesses: From Partnership to Limited Company

Family businesses form the backbone of the Australian economy, with many starting as simple partnerships...

Net cash flow tax: What is it and what will it mean for SMEs?

As differing opinions circulate at the top end of town about the potential impacts of a net cash flow tax, its...

informed

latest news from the industryTools & Resources

efficient

free tools and resources for anyoneCareers

meticulous

precise and with a keen eye for detailAccount Payments

You can pay your invoices to us online via credit card.

By clicking the link below you will be transferred to Westpac where you will be asked for your payment details. All transactions are processed in AUD.

Refund Policy

We do not normally give refunds as the payment you are about to make is for services rendered. In the case of a situation where you may have overpaid your invoice, we will credit you the amount overpaid.

Security Policy

When purchasing from Wybenga & Partners Pty Limited your financial details are passed through a secure server using the latest 128-bit SSL (secure sockets layer) encryption technology. 128-bit SSL encryption is the current industry standard. If you have any questions regarding our security policy, please contact our customer support centre at .

Contact Us

Wybenga & Partners welcome your enquiry. To book an appointment or simply ask us a question, fill in your details and we'll be in touch soon!

Email, Phone & Fax

- +61 2 9300 3000

- +61 2 9300 3099

Office Address

- Level 9, 37 York Street, Sydney NSW 2000

- 9:00AM to 5:00PM (Mon-Fri)

Postal Address

- PO Box R896, Royal Exchange, Sydney NSW 1225